Foreign Trade Zone 92

What is the Mississippi Coast

Foreign Trade Zone 92?

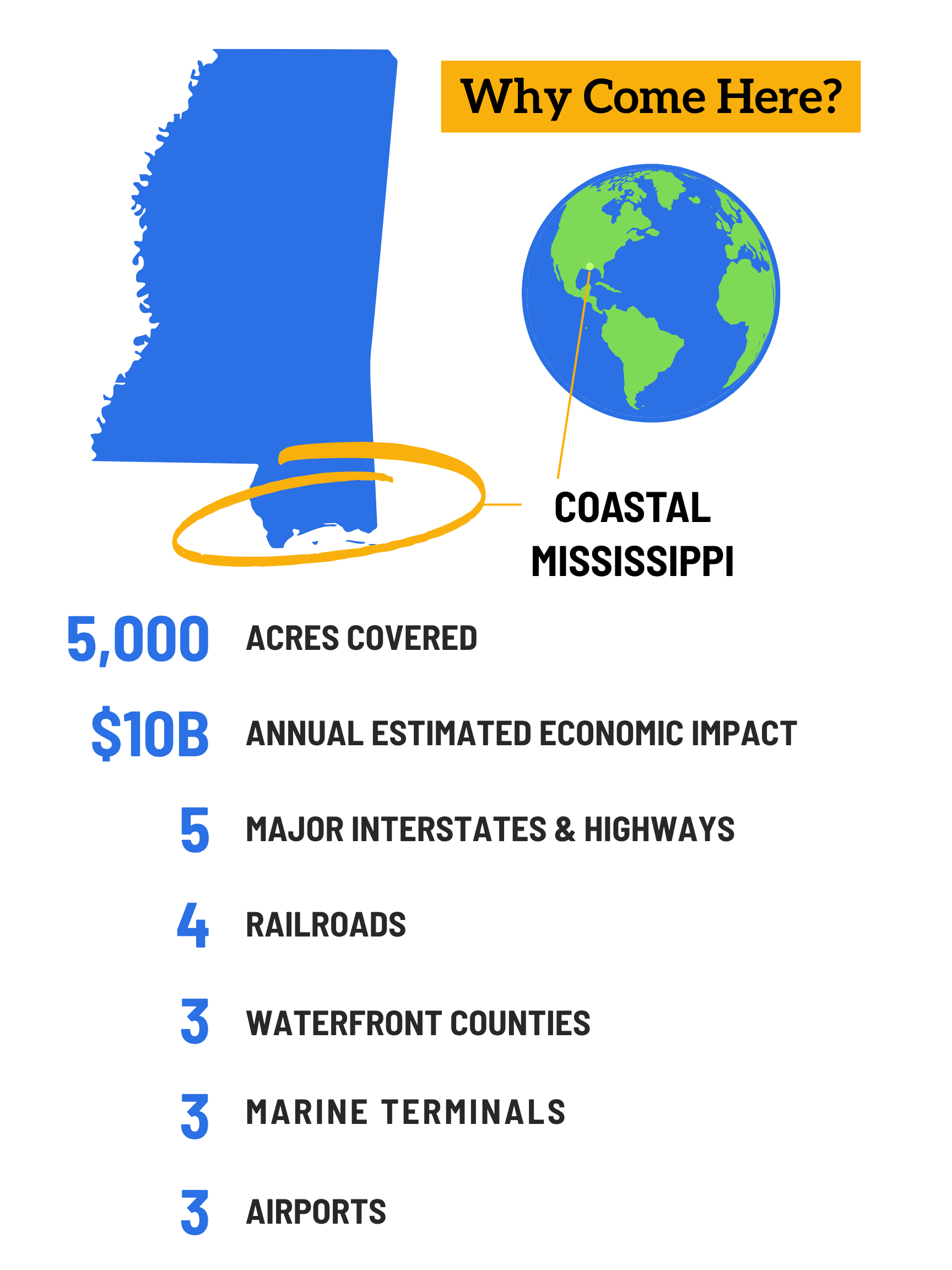

The Mississippi Coast Foreign Trade Zone (FTZ #92) is 5,000 acres of secured sites at airports, ports and industrial parks located within the Mississippi counties of Hancock, Harrison, and Jackson.

These Mississippi Gulf Coast counties lie along the north central Gulf of Mexico in the multi-modal transportation center of the state. All necessary governmental agencies to facilitate the uncomplicated importation and exportation of products are readily available at each site within the Mississippi Coast Foreign Trade Zone.

HCDC oversees the administration of FTZ 92.

-

Help facilitate and expedite international trade.

Help firms conduct international trade-related operations in competition with foreign facilities.

Help attract offshore activity and encourage retention of domestic activity.

Assist state/local economic development efforts.

Help create and maintain employment opportunities.

-

Deferred until all or part of the shipment is entered for U.S. consumption

Reduced when processing in the FTZ changes the tariff classification

Avoided when goods are re-exported from the zone

Eliminated on items that become damaged or obsolete while in the FTZ

Request for Quotes

There are currently no open RQFs at this time.